Table of Content

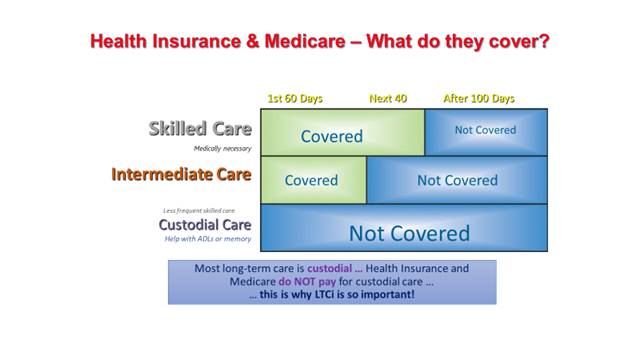

It includes services like physical therapy or changing sterile dressings. In assisted living environments, this care may be covered by Medicare Part A. The other challenging part of the equation is that Medicare only covers temporary care in a skilled nursing facility. If you have Original Medicare, you are fully covered for a stay up to 20 days. After the 20th day, you will be responsible for a co-insurance payment for each day at a rate of $176 per day.

This includes the routine, sometimes “unskilled” services like help with bathing, dressing, or bathroom use. Medicare may cover a limited number of services within nursing homes for patients who meet specific criteria. Original Medicare only pays for nursing home care up to 100 days maximum . Some Medicare Advantage plans may also offer partial coverage, but only if the nursing home contracts with that plan. Upon becoming eligible for Medicaid, all of the applicant's income must be used to pay for the nursing home where the applicant resides.

How Much Will Medicaid Pay For Nursing Home Care

Medicaid eligibility is based on a person's monthly income, which may include a pension, Social Security and other payments, plus “countable” assets. Also, read this if you would like information about when to apply for long-term care insurance. Nursing home care is expensive — these costs include care for increasingly sicker patients, employee shortages, and greater regulations that increase expenses all account for rising costs. Those who served in the military may be able to receive financial assistance for long-term care services through the United States Department of Veterans Affairs.

Whether your income level qualifies you or your family for Medicaid depends on the size of your family and the Medicaid program for which you are applying. Mandatory benefits include services including inpatient and outpatient hospital services, physician services, laboratory and x-ray services, and home health services, among others. Optional benefits include services including prescription drugs, case management, physical therapy, and occupational therapy. A private duty nurse is a registered nurse who provides patients with one-on-one, long-term care in their homes.

How Much Can You Make And Qualify For Medicaid

Medicare will also cover the cost of preventative care for a person who suffers from a memory condition. This can include medical equipment, doctors’ appointments, physical therapy, and diagnostic testing. You may be able to receive coverage through Medicare Part A if a physician deems it is “medically necessary” for you to have skilled nursing care. According to Medicare, Medicare Part A can cover inpatient hospital stays, a skilled nursing facility, hospice care, and some home health care services. For example, Medicare Part A can cover wound care or medication management in an inpatient hospital care setting. Some of the most common services that can be covered by Medicare Part A include prescription medications, changing sterile dressings, or nutrition-related services and meals.

Medicare Advantage Plan ProviderUnitedHealthcareRoutine exams covered $200 allowance for lenses every year.You can search for plans on the Medicare website. If you anticipate the need for vision care and corrective lenses, its a good idea to check with your eye care provider to see if they are in-network with the plan you choose. MA plans cover all services that Original Medicare Part B does, plus help with routine eye exams and corrective lenses. When first joining Medicare, Medicare Part B users have the option to receive a vision test as part of their Welcome to Medicare preventive visit. The test is simple, and it isnt as comprehensive or in-depth as a proper eye exam.

How Do I Apply For Medicare Part A Online

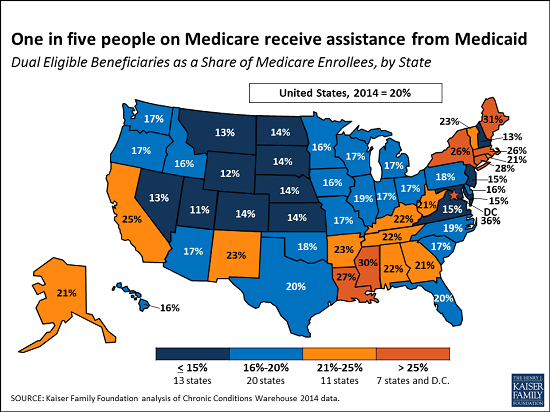

We explain what home health services Medicare covers, how to qualify, costs, and more. They found the average 2019 cost of a private room in a nursing home is $102,200 per year, which is a 56.78 percent increase from 2004. Care in an assisted living facility costs on average $48,612 per year, a 68.79 percent increase from 2004. Financial organization Genworth tracked the cost of care in skilled nursing facilities and nursing homes from 2004 to 2019. Each state operates its own Medicaid system, but this system must conform to federal guidelines in order for the state to receive federal money, which pays for about half the states Medicaid costs.

However, most Medicaid reimbursement models pay providers through either managed care or fee-for-service or some combination of the two. By far one of the easiest and best ways to find a private caregiver is to have a personal recommendation from a trusted friend or relative. Word of mouth is often the most successful means, so be sure to ask neighbors, acquaintances from your church, clubs, and organizations where you are a member. You must be under the care of a doctor, and you must be getting services under a plan of care created and reviewed regularly by a doctor. The material of this web site is provided for informational purposes only. AgingCare.com does not provide medical advice, diagnosis or treatment; or legal, or financial or any other professional services advice.

This is intensive medical care for persons who are in the process of recovering from an illness or injury. Examples include stroke recovery, rehabilitation after breaking a hip, and wound care following an operation. Medicaid will pay for memory care in any facility that has a contract to offer Medicaid services. Some of these may include specialized assisted living homes, or they may be separate wings inside of a nursing care facility. For any independent long-term care home, assisted living community, or memory care facility, Medicaid will cover the services listed in the assisted living section we have listed earlier in the article.

There are a few upsides to being eligible for both Medicaid and private insurance. Medicare can work with other insurance plans to cover your healthcare needs. When you use Medicare and another insurance plan together, each insurance covers part of the cost of your service. The insurance that picks up the remaining cost is the secondary payer.

These protections allow you dedicate some of your income or resources to a spouse. If your spouse is not also applying for a Medicaid waiver, their income and resources usually wont count. For example, in Florida, a spouse can keep $120,000 of shared assets . How Medicaid Planning Trusts Protect Assets and Homes From Estate Recovery. Medicaid Asset Protection Trusts, American Council on Aging, 28 March 2019, medicaidplanningassistance.org.

When planning for long term care, it is also important to understand which services are covered or excluded by Medicaid and Medicare. If you are 60 or older, you may qualify for Pennsylvaniaâs Aging Waiver. The program offers home-delivered meals, home health services, transportation, personal assistance, emergency response systems, and accessibility modifications to your home. Your skilled nursing care is administered in a Medicare-certified SNF.

Lastly, look into your state, regional, or local agencies and organizations on aging. They may have information on additional resources, offer benefits and financial counseling, and help walk you through government programs like Medicaid and Medicare. Research each option and talk to friends and family members who have navigated paying for assisted living. Consider speaking to a trustworthy financial advisor or elder care attorney who can help you decide how best to use or invest your current assets for future long-term care needs. A reverse mortgage is a loan that allows homeowners to tap into the equity in their homes and use it to pay for things like home repairs, medical expenses, or in this case, the cost of assisted living. The loan is repaid when the home is sold after the borrower dies or moves out permanently.

However, you can avoid this from happening if you work with a certified financial advisor to plan as early as possible. By planning ahead, you will be able to protect assets, plan for future care needs, and give you and your family peace of mind. If you are suffering from a serious illness or disability, you may eventually need to move into a facility that provides constant care, but that can be a problem without advance planning. While Medicaid covers the cost of a nursing home for those who qualify, unexpected problems during the lengthy application period may put your family in a difficult financial situation.

However, there are exceptions for the short-term provision of similar services. For example, Medicare will cover stays in skilled nursing facilities for short-term rehabilitation following a qualifying hospital stay. Medicaid is a jointly funded federal and state medical assistance program that provides health coverage for low-income Americans with few assets.

No comments:

Post a Comment